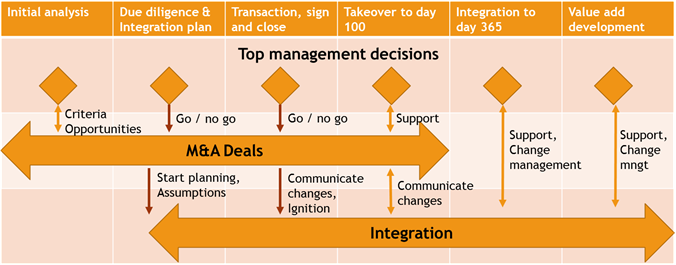

Some M&A practitioners see a merger or an acquisition as a unique project. If an organization really merges or acquires once, this might be the only way to go. Most M&A professionals see M&A as on ongoing process with new opportunities and deals following each other with ever improving ways of making each deal a success story. My suggestion for improvement is, that instead of one M&A process M&A consists of two concurrent processes interacting with top management's decision making practices.

- Integration gets the attention it needs. In deal focused view the attention withers after 100 days. In 100 day you can merely complete takeover, but not make it a success story.The integration is planned sooner and the momentum is better exploited.

- Deal making and Integration require different kind of competencies and skills and thus different process managers. Integration is often like gardening. You have to seed, weed and breed your plants to get garden of your dreams. Deal making might resemble more like using a machine.

My other suggestion for improving M&A practices is to start using software tools that support both deal making and integrations. The most important benefits are

- Ability to seize the momentum right after signing the deal. Software allows you to start actions soon in all streams like finance, human relations, product management and delivery process. Without software, your "clock speed" is limited by human factors

- Ability to learn. With a software you can learn from each deal, workshop and released news.

Simbain offers consulting services for M&A processes. Our range of services covers most parts of integration and selected parts of pre-deal and takeover phases. Our companion in international projects is Global PMI Partners www.gpmip.com. Our recommended software is Midaxo www.midaxo.com.